Challenges in Regulatory Control: Understanding the Struggles of Regulators

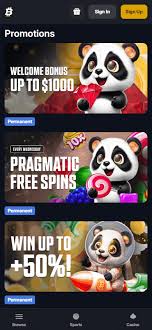

Regulatory bodies are established with the intent of overseeing various sectors to protect the interests of consumers, ensure fair markets, and maintain the stability of economies. However, these institutions often find themselves entangled in a web of challenges that impede their effectiveness. An array of factors contributes to why regulators struggle to control many aspects of modern economies. One illustrative example can be seen in the evolving landscape of financial technologies, such as cryptocurrencies and digital trading platforms like Why Regulators Struggle to Control Web3 Casinos Bitfortune .com, which present unique regulatory challenges.

The Complexity of Modern Markets

One of the primary reasons regulators face difficulties is the sheer complexity of modern markets. The globalization of trade and the rapid evolution of technology mean that financial systems, consumer behavior, and market dynamics are constantly changing. As companies innovate and new business models emerge, regulators often find themselves playing catch-up. This lag can result in outdated regulations that are ill-equipped to manage new realities.

Innovative Technologies

Technological advancements bring about disruptive changes. Fintech, digital currencies, and blockchain technology have created new financial ecosystems that operate outside traditional banking systems. Regulators struggle to define their jurisdiction and apply existing regulations to these novel entities, leading to inconsistencies and loopholes. This complexity requires a deeper understanding of technology by regulatory bodies, who often rely on traditional expertise that does not cover these innovations.

Political and Economic Pressures

Political influences play a significant role in the effectiveness of regulation. Government agendas may push regulators to prioritize economic growth over strict oversight, leading to a culture of leniency. In democratic nations, regulators are often subject to political pressures that can impede their independence, making them reluctant to impose strict regulations that could hamper business growth.

The Influence of Lobbying

The role of lobbying cannot be understated in this context. Industry groups heavily invest in lobbying efforts to influence regulatory frameworks in their favor. This can create a conflict of interest, as regulators may prioritize the interests of powerful corporations over consumer protection. It poses a significant challenge when regulatory goals conflict with the economic interests of influential stakeholders.

Regulatory Fragmentation

Another obstacle is regulatory fragmentation. Different countries have different sets of regulations, leading to a complex web of jurisdictional challenges. This fragmentation complicates enforcement, as entities operating across borders may evade regulations by leveraging weaker jurisdictions. Regulators must collaborate, yet varying laws and practices make unified approaches difficult.

Compliance Challenges for Businesses

Businesses often face significant compliance burdens, leading them to seek ways to minimize regulatory impacts. Some firms may choose to engage in regulatory arbitrage—moving their operations to regions with looser regulations. This behavior undermines the objectives of regulation, creating a race to the bottom rather than fostering a level playing field.

Rapid Change in Consumer Behavior

The pace at which consumer preferences shift is also a challenge for regulators. With the rise of the internet and social media, consumers are empowered and able to access information more quickly than ever. Regulators may struggle to keep up with trends like online shopping, gig economies, and subscription models, which often move faster than the regulatory process can adapt.

The Challenge of Consumer Protections

As consumer preferences evolve, so do risks. For instance, online platforms can expose individuals to significant risks, including data breaches or misleading practices. Regulators, aware of these risks, may attempt to enforce standards but often find it difficult to keep guidelines relevant and comprehensive without restricting innovation.

International Cooperation and Regulatory Trends

In an increasingly interconnected world, international cooperation becomes essential. Regulatory bodies must work together to address cross-border challenges, yet different countries have varying priorities. This misalignment can lead to conflicting regulations and enforcement challenges, as seen in differing attitudes towards privacy laws and data protection.

Setting Global Standards

Efforts to establish global standards often face significant obstacles due to varying economic conditions, cultural practices, and legislative priorities. When regulations differ significantly across jurisdictions, companies may choose to operate in countries with more favorable environments, further complicating compliance for international entities.

Future Directions for Regulators

Looking ahead, there is a pressing need for regulators to adapt their strategies. Embracing technology, such as utilizing data analytics and AI, can help them better anticipate and respond to market changes. Additionally, fostering collaboration with industries can lead to better-informed regulations that balance innovation with consumer protection.

Education and Expertise Development

Investing in education and building expertise within regulatory bodies is crucial. Regulators need to encompass diverse viewpoints and enhance their understanding of emerging technologies. Creating partnerships with tech companies can provide insights that enable regulators to craft forward-thinking policies.

Conclusion

Regulators face a multitude of challenges in their quest to maintain control over rapidly changing markets and technologies. From political pressures and fragmentation to consumer behavior and international cooperation, the landscape is complex and often contentious. While they may struggle, it is imperative that regulators find new ways to adapt and evolve. As they navigate their roles, focusing on collaboration, education, and responsiveness will be key to overcoming the hurdles they face. Ultimately, a balanced approach that nurtures innovation while ensuring consumer protections will be essential for successful regulatory frameworks in the years to come.